Degrowth, Expensive Oil, and the New Economics of Energy

The PDF is available here:

Our understandings and expectations of the world have been shaped by our experience of economic growth. The dynamic stability of that growth has habituated us to what is ‘normal.’ That normal must soon shatter. – David Korowicz

Samuel Alexander[1]

1. Preparing for Life after Growth

In this post I wish to develop some of the ideas outlined in my paper ‘Peak Oil, Energy Descent, and the Fate of Consumerism,’ which I published through the Simplicity Institute last year (Alexander, 2011a). Building upon the ‘limits to growth’ perspective (Meadows et al, 2004), and drawing upon the work of various energy analysts (Ayers and Warr, 2009; Murphy and Hall, 2011a-b), my paper was based on the view that, in order to grow, industrial economies require a cheap and abundant supply of energy, especially oil. When the costs of oil increase significantly, this adds extra costs to transport, mechanised labour, and industrial food production, among many other things, and this pricing dynamic sucks discretionary expenditure and investment away from the rest of the economy, causing debt defaults, economic stagnation, recessions, or even longer-term depressions. That seems to be what we are seeing around the world today, with the risk of worse things to come (Tverberg, 2012a). Since crude oil production has been on an undulating plateau since 2005 while demand has increased (Hirsch et al, 2010), this has put huge upward pressure on the price of oil, and several commentators have drawn the conclusion that these high oil prices signify the end (Heinberg, 2011; Rubin, 2012) or at least the twilight (Alexander, 2011a; 2012a) of economic growth globally. If this is true, we are living at the dawn of a new age, and should be bracing for impact.

Some new research and data, reviewed below, has come to light that seems to confirm this essential message. Expensive oil, in other words, does appear to be suffocating the debt-ridden, global economy, just as it is trying to recover (Hamilton, 2011; Tverberg, 2012b). Unfortunately, mainstream economists, including those in government, seem oblivious to the close relationship between energy, debt, and economy, and this means they are unable to see that expensive oil is one of the primary underlying causes of today’s economic problems. Consequently, they craft their intended solutions (e.g. stimulus packages, quantitative easing, low interest rates to encourage borrowing, etc) based on flawed, growth-based thinking, not recognising that the new economics of energy means that the growth model, which assumes cheap energy inputs, is now dangerously out-dated. When growth-based economies do not grow, household, firms, and nations struggle to repay their debts, and quickly things begin to unravel in undesirable ways.

Furthermore, even many of the most progressive ‘ecological economists’ fail to appreciate the important relationships between energy, debt, and economic growth. For several decades advocates of a ‘steady state’ economy (e.g. Daly, 1996) have been arguing persuasively that we need to move beyond the growth model, for various social and environmental reasons (Victor, 2008; Jackson, 2009). But very few seem to realise that interest-bearing loans are incompatible with a steady-state economy due to the fact that repaying debts plus interest implies growth (Sorrell, 2010; Trainer, 2011). Many ecological economists are against growth, without being against interest-bearing loans, and it is not clear that this is a coherent position. It is a tension that certainly deserves more critical consideration.

Similarly, ecological economists who argue for decarbonising the economy do not seem to realise quite how revolutionary this proposal is – which is not to say the proposal is misconceived (Hansen et al, 2008), only that its economic implications may be misunderstood. If the global economy managed to wean itself of fossil fuels over the next few decades in response to climate change, then a ‘steady state’ economy would be impossible, if a steady state is meant to imply maintaining anything like existing levels of affluence. It would be impossible because fossil fuels currently make up around 80% of global energy supply (IEA, 2010a: 6), and nothing like existing production could be maintained when we are talking about that level of fossil fuel reduction. Without fossil fuels, the world just would not have the energy supply to maintain a steady state of economic output; the economy would have to contract significantly. This is not a consequence many ecological economists seem to understand or dare to acknowledge.

While I accept that the world must transition to renewable energy sources without delay, evidence suggests that such sources will never be able to replace (fully or affordably) the energy contained in fossil fuels, especially oil (Trainer, 2012a; 2010a). Renewable sources are also fossil fuel dependent themselves, a point often and easily forgotten. Therefore, if we are serious about tackling climate change and getting off fossil fuels, we should be preparing ourselves for a world with perhaps half as much energy consumption, and this implies embracing, not a steady state economy, but some ‘degrowth’ process of planned economic contraction (Alexander, 2012b; 2011b). As the world’s population grows to nine or ten billion in coming decades, this reasoning is only going to get more challenging, because sustainable energy consumption on a per capita basis will decline even further. It is worth noting that even if there were no energy supply problems, the fact that the existing economy already greatly exceeds the sustainable carrying capacity of the planet (Global Footprint Network, 2012) means that significant overall economic contraction of some form would still be required (Alexander, 2012b; Clarke and Lawn, 2010; Latouche, 2009).

Needless to say, the powers that be are not willing even to entertain this ‘degrowth’ diagnosis or its radical implications, for it implies establishing fundamentally new economic systems that operate on much lower energy inputs. Empire, we can be sure, will not contemplate self-annihilation; it will struggle for existence all the way down. In much the same vein, consumerist cultures are very unlikely to accept any proposal to voluntarily reduce levels of consumption. Overcoming or dealing with these forms of resistance is the near impossible task that lies before those of us who seek a radically alternative, post-carbon economy (Trainer, 2010b; Heinberg and Leach, 2010; Alexander, 2011c).

1.1. A New Economics of Energy

If the world is to deal effectively with the ecological and economic problems it is facing, we urgently need to infuse a new economics of energy into our economic thinking and economic systems, both at the local and macro-economic levels. There is arguably scope for this transition to be a prosperous descent (Odum and Odum, 2001), but given how entrenched the growth model is, especially at the governmental level (Hamilton, 2003), a voluntary transition beyond growth economics will be neither easy nor likely. For those who do not expect governments to take the lead in this transition, I believe the best path forward is to begin preparing for economic contraction at the personal and community levels, by minimising consumption through voluntary simplicity (Alexander, 2009; Alexander and Ussher, 2012; Trainer, 2010), getting out of debt, and building local resilience in the manner of Transition Initiatives (Hopkins, 2008; Holmgren, 2012). Most of all, we need to get used to living with a lot less energy. While ultimately the aim should be to build a fundamentally new, degrowth economy ‘from below’ and thus effectively replace existing economic structures by ignoring growth capitalism to death (Trainer, 2010; Alexander, 2012a; 2012c), it may be that ‘resilience’ – the ability to withstand forthcoming shocks – is the most we can reasonably hope for (Alexander, 2012d; Barry, 2012).

Life is too complex and has too many variables at play for anyone to know with much certainty the nature of forthcoming shocks, exactly when they are going to hit, or how hard, but a confronting body of evidence is indicating that we ought be at work preparing our local economies for life after growth (Heinberg, 2011; Hirsch et al, 2010). We cannot rely on governments to lead us on this transition, for they seem committed to doing everything they can to maintain and conserve the existing system, which is counter-productive since that system appears to have no future (Gilding, 2011; Meadows et al, 2004). It is almost certain that we are going to have to build the new economy ourselves, at the household and community levels.

Before these grassroots strategies and goals will be taken up en masse, more people need to understand the relationship between energy and economics. I hope this paper serves to draw more attention to these important issues, with the aim of opening up the debate for a wider discussion rather than attempting to end it. I’m afraid these issues are not going away. Mother Nature will make sure of that.

2. Energy and Economics

Although the relationship between energy and economics can get very complex quite quickly, the basic dynamics can be easily grasped and conveyed. In this section I wish to outline the nature of those dynamics.

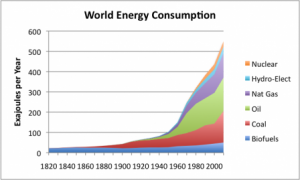

Figure 1. World Energy Consumption by Source, based on Vaclav Smil estimates from Energy Transition: History, Requirement and Prospectstogether with BP Statistical Data for 1965 and subsequent. The biofuel category also includes wind, solar, and other new renewables. Graph from Gail Tverberg (2012c), ‘World Energy Consumption Since 1820 in Charts.’

The first point to note is that there has always been a very close correlation between energy consumption and economic growth (Ayers and Warr, 2009; Stern and Kander, 2011), which should really come as no surprise. Quite simply, productive activity takes energy, and many studies and events have demonstrated that when energy supply has not met demand, economies suffer, often to the point of recession (e.g. Hamilton, 2010; Tverberg, 2012a). Furthermore, it has been shown that energy production growth drives economic growth, rather than the reverse. In a recent study, Ayres and Warr (2010: 1692) examined this issue and explain their results as follows:

[G]rowth does not drive increased exergy/useful work consumption, rather output growth is ‘driven’ by increased availability of energy and increased delivery of useful work to the economy. [These findings] provide clear evidence of the importance of the quantity of energy consumption for GDP growth and that efforts to reduce exergy consumption may have a negative effect on future GDP growth rates.

What is surprising, however, is that dominant macro-economic theories (e.g. Solow, 1956) do not include energy in their economic models, which means that if we use those models to think about the world, there is no reason to think that a stagnation or decline in energy supply need affect economic growth (for a critical review, see Hall and Klitgaard, 2012).

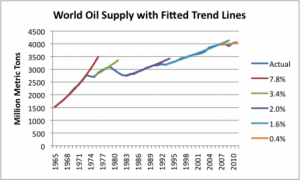

The reason mainstream economists have been able to get away with not taking energy into account in their macro-economic models is because, especially over the last few decades, energy has been so cheap, and its supply so readily available, that ignoring its role in economic growth has not interfered significantly with the model’s ability to make reasonably accurate macro-economic predictions (at least at times). But if we are facing a future of stagnating supplies of oil (see Figure 2 below) and thus high oil prices, then energy is going to play an ever-larger role in the costs of production and distribution, the implications of which are only now being rigorously fleshed out. Figure 3., on the following page, suggests that the slowing of oil growth (Figure 2) is retarding GDP growth.

Figure 2. World oil supply with exponential trend lines fitted by Gail Tverberg. Oil Consumption data from BP 2012 Statistical Review of World Energy. Graph from Gail Tverberg (2012d), ‘Evidence that Oil Limits are Leading to Declining Economic Growth.’

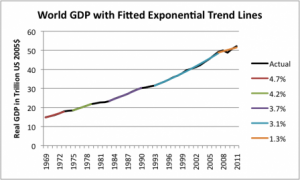

Figure 3. World Real GDP, with fitted exponential trend lines for selected time periods. World Real GDP data from USDA Economic Research Service. Fitted periods are 1969-1973. 1975-1979, 1983-1990, 1993-2007, and 2007-2011. Graph from Gail Tverberg (2012d), ‘Evidence that Oil Limits are Leading to Declining Economic Growth.’

Several economists and energy analysts (Murphy and Hall, 2011a-b; Stern and Kander, 2011; Tverberg, 2012a-b; Rubin, 2012) have started placing energy at the centre of macro-economic models (see also, Georgescu-Roegen, 1971), and these models provide grounds for thinking that the end of the age of cheap oil may very well signify the twilight of economic growth. Prominent energy-economists, Murphy and Hall (2011a: 70), make the essential point as follows:

when energy prices increase, expenditures are re-allocated from areas that had previously added to GDP, mainly discretionary consumption, towards simply paying for the more expensive energy. In this way, higher energy prices lead to recessions by diverting money from the economy towards energy only. The data show that recessions occur when petroleum expenditures as a percent of GDP climb above a threshold of roughly 5.5%.

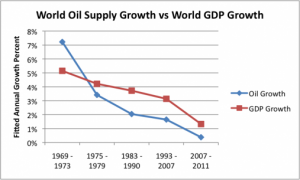

If economic growth is indeed dependent on a threshold energy price in this way, then it is very likely that we are approaching a momentous turning point in human history. For two centuries the dominant narrative of human progress has been based on economic growth (Purdey, 2010), but if growth depends on cheap oil, the current stagnation in crude oil supplies may very well be ushering in the ‘end of growth.’ Figure 4 below shows a trend that suggests that very soon we should expect the world economy to stop growing. This is something that is going to change the world so fundamentally that its foreseeable arrival ought to be taken very seriously indeed. Unfortunately, most people, including the world’s leaders, remain firmly entrenched in a macro-economic paradigm that seeks or assumes cheap energy and expects growth without limits. That paradigm, however, is in the process of colliding with reality (Meadows et al, 2004; Bardi, 2011).

Figure 4. World Oil Supply Growth vs. Growth in World GDP, based on exponential trend lines fitted to values for selected groups of years. World GDP based on USDA Economic Research Data. Graph from Gail Tverberg (2012d), ‘Evidence that Oil Limits are Leading to Declining Economic Growth.’

A further economic point to consider in this context is that the trillions of dollars of debt that many nations have taken on in recent decades was predicated on the assumption that future growth would be similar to the growth experienced over the last few decades. But if it is the case that we have entered the twilight of economic growth, those debts may very well become bad debts, and sooner than anyone might like to think. This would destabilise the highly interconnected global economy, with implications that no one can really foresee with any precision, due to the many unpredictable variables at play. Suffice it to say that it would probably not be good news. Exactly how to transition away from a debt-based and growth-based monetary system, and what to replace it with, are questions far beyond the scope of this paper; but these are questions that must be given more attention (see Douthwaite and Fallon, 2011; Trainer, 2011).

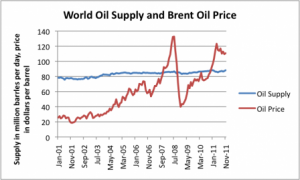

Figure 5. Brent oil spot price and world oil supply (broadly defined), based on EIA data. Graph from Gail Tverberg (2012e), ‘Why High Oil Prices Are Now Affecting Europe More Than the US.’

For present purposes, the most important economic dynamics of expensive oil can be summarised as follows.

Crude oil production seems to have reached an undulating plateau, and growth in overall oil supplies is very small. The unexpectedly high decline rates in existing wells (IEA, 2008) means that the supply of non-conventional oil and biofuels have been struggling to offset those declines. As more nations pass their peak production in coming years, and as existing wells continue to decline, a stagnation and eventual decline in overall oil supplies (or share of the supplies) seems highly likely, and eventually inevitable. When we realise that demand for oil is still expected to grow significantly, despite this stagnation and decline in supply, the economic implications of peak oil become clear.

The most basic economic principles tell us that as the supply of a commodity decreases and demand increases, the price of that commodity will increase. That is what the world can expect in the future, and in fact today’s high oil prices are primarily a result of these dynamics of supply and demand already beginning to operate in the global oil markets. And here we are touching on what is arguably the most important implication of the ‘peak oil’ phenomenon. The issue is not that the world will ever run out of oil, a point that should not be forgotten. The issue is that we have reached the end of the age of cheap oil, a point acknowledged even by the most mainstream institutions (IEA, 2010b). These supply and demand dynamics described above are exacerbated by the fact that alternatives to crude oil – such as the non-conventional oil derived from the tar sands or deep-sea drilling, or biofuels – are always much more expensive to produce, due primarily to their lower energy returns on investment (Murphy and Hall, 2011b).

Over the last few years we have seen how fragile and delicate the global economic system is – owing in a large part to its dependency on cheap oil. More specifically, we saw the price of oil increase steadily as the peak of crude oil was approached; and as the supply of crude oil stagnated while demand continued to increase, we saw the price of oil spike to historic highs in July 2008 (see Figure, 5 above). Although mainstream media attributed the global economic crash in 2008 to the sub-prime fiasco that originated on Wall Street and materialised in Cleveland – and while there is surely some truth to that account – the untold story is the role that oil prices played, and continues to play, in the global financial crisis. In other words, the global financial crisis is arguably a product of expensive oil, not sub-prime lending (e.g. Rubin, 2009; 2012), in the sense that the bursting of the property bubble in the US was a symptom rather than a cause of the financial crisis, and that the real reason the bubble burst was high oil prices.

This view receives some further support from economist, James Hamilton (2010), who has shown in a recent paper that 10 out of the 11 economic recessions experienced by the US post-WII were preceded by high oil prices. There are others (e.g. Stern and Kander, 2011; Ayers and Warr, 2009; 2010) who have also drawn the same connection between economic growth and energy supply. Given how dependent the global economy is on cheap oil, however, it is rather surprising that so few people have made the link between the economic crash and the spike in oil prices.

Unfortunately, this is probably a lesson that is going to be taught and retaught in coming years and decades (Tverberg, 2012a). The global economy simply cannot withstand the economic impacts of oil prices much in excess of $100 per barrel – primarily because so much trade is now international and therefore dependent on oil for the transportation of goods. But when oil prices get so high that the economy cannot function – which arguably is what happened in 2008 – the economy struggles to grow, and this reduction in economic activity means a reduction in oil demand, and this reduced demand makes the price of oil crash also. This is what happened, in fact, after the crash in 2008 (see Figure, 5 above), and it is what typically happens when the demand for oil is reduced because of economic recession. Low oil prices, however, then aid economic recovery, but as economies recover from recession and begin to grow again, this puts more demand pressure on stagnating oil supplies, and the cycle repeats itself. Put otherwise, oil prices increase till economic breaking point, then economies crash, which leads to a crash in oil prices; the low oil prices then facilitate economic recovery, which puts more demand pressure on oil, leading prices to rise till economic breaking point, and so and so forth.

This cycle of bust-recovery-bust is probably what we should expect in coming years and decades, and as oil supplies decline, economic contraction is what we should expect and prepare for. The world is unlikely to escape this unhappy cycle until it transitions beyond a growth-based economy and breaks its addiction to oil. But that implies creating a fundamentally different type of economy, probably something resembling Ted Trainer’s ‘Simpler Way’ (Trainer, 2010b; Alexander, 2012e), and if one honestly assesses the likelihood of such a voluntary transition, the chances look slim to non-existent.

This point about breaking our addiction to oil deserves some brief elaboration, because it raises the spectre of what Tom Murphy (2011) has called the ‘energy trap.’ In order to break the addiction to oil, economies dependent on oil arguably need to invest huge amounts of money and energy in building new social and economic infrastructures that are not so heavily dependent on oil (e.g. efficient public transport systems to incentivise people to drive less; localise food production and critical manufacturing, etc.). But since this transition has not yet seriously begun, the necessary investment of money and energy is going to be required at a time when money and energy are scarcer than they have been in recent decades. This places us in the ‘energy trap.’ Politicians are going to have a short-term incentive not to invest extra money and energy in new infrastructure, since people will already be feeling the pinch of high oil prices. This means that there will be very little or no surplus money and energy to direct towards the necessary infrastructure projects. But while this will provide some short-term relief for people and politicians, it delays the inevitable need for that new infrastructure. But a delay only exacerbates the problem, since the necessary investment will then need to come later, at a time when energy and money are scarcer still (see also, Hirsch et al, 2005).

3. Conclusion

This report has attempted to outline in a very preliminary way some of the most important aspects of the relationship between energy and economics. As noted from the outset, the purpose was not to close the discussion, but to draw more attention to the issues under consideration.

Economic growth requires energy, especially oil. Stagnating oil production, however, is happening at a time when demand is continuing to rise. This means that oil is going to get more expensive – a consequence already playing out – but it is not clear that our economies can function on oil prices much above $100 per barrel or when total oil expenditure exceeds roughly 5.5% of GDP. The exact figures can be debated, and will be debated. But a strong case can be made that the price implications of slow-to-negligible growth in crude oil production is causing the global economy to stagnate, leading, among other things, to the inability of many households, firms, and nations to meet their debt obligations. This is causing significant economic instability around the world, and as oil prices rise in the future the situation is probably only going to get worse. This is not a happy message to convey, but in order to respond to problems effectively it is important that first their gravity is recognised and acknowledged.

In closing, I wish to reiterate the point raised in the introduction about the revolutionary implications of decarbonising our economies as a response to climate change. The latest evidence on climate change (see McKibben, 2012) does not present a pretty picture, implying that globally efforts to reduce fossil fuel consumption must increase by several orders of magnitude. A reduction of 80% by 2050 is a figure that is widely discussed as an appropriate goal, but that figure is rarely considered in the context of energy’s relationship to economic output.

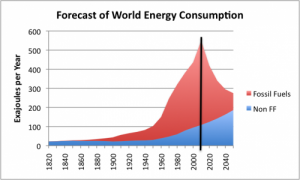

Figure 6. Forecast of world energy consumption, assuming fossil fuel consumption decreases by 80% by 2050, and non fossil fuels increase so that total fuel consumption decreases by ‘only’ 50%. Amounts before black line are actual; amounts after black lines are forecast in this scenario. Graph from Gail Tverberg (2012c), ‘World Energy Consumption Since 1820 in Charts.’

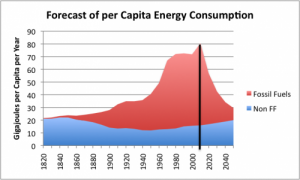

Figure 7. Forecast of per capita energy consumption, using the energy estimates in Figure 6 divided by world population estimates by the UN. Amounts before the black line are actual; after the black line are estimates. Graph from Gail Tverberg (2012c), ‘World Energy Consumption Since 1820 in Charts.’

Although it is wildly optimistic to suppose that the world is actually going to reduce fossil fuel consumption 80% by 2050 (see Figure 6 and 7 above), suppose it did? Suppose further that renewable energy is able to be ramped up so that total energy consumption is ‘only’ reduced by 50%. Since, as we have seen, productive activity is closely tied to energy consumption, exactly what type of economy would exist if the global economy only used half as much energy as it does today?

That is the question we must ask ourselves if we are truly attempting to understand what a transition to a just and sustainable world would look like. And if we ever managed to create such a world, it would seem that sustainable levels of resource and energy consumption would mean that we would all be living lives of radical simplicity. I hasten to add that this need not, in itself, be an undesirable change, if it were voluntarily chosen and wisely negotiated. Indeed, I am convinced that there can still be a ‘prosperous way down’ (Odum and Odum, 2001; Alexander, 2012d). But if, due to some form of collapse scenario, radical simplicity were to be forced upon people in coming decades, as it is already for many people today, one must admit that life in the future is going to entail unprecedented levels of suffering.

We are at the crossroads and are in the process of choosing our fate.

The PDF of this working paper is available here:

“Degrowth, Expensive Oil, and the New Economics of Energy“

Acknowledgements

I would like to express my thanks and gratitude to Gail Tverberg for providing such excellent resources on her website, ‘Our Finite World,’ and for allowing others to use her graphs under a Creative Commons licence.

References

Alexander, S., ed., 2009. Voluntary Simplicity: The Poetic Alternative to Consumer Culture, Stead & Daughters, Whanganui.

Alexander, S. 2011a, ‘Peak Oil, Energy Descent, and the Fate of Consumerism’ Simplicity Institute Report 11b.

Alexander, S., 2011b, ‘Property beyond Growth: Toward a Politics of Voluntary Simplicity’ (doctoral thesis, Melbourne Law School, University of Melbourne) available at http://www.simplicityinstitute.org/publications [accessed 5 May 2011]

Alexander, S., 2012a. ‘Peak Oil and the Twilight of Growth,’ 37(2) Alternative Law Journal 86.

Alexander, S., 2012b, ‘Planned Economic Contraction: The Emerging Case for Degrowth’ Environmental Politics (forthcoming).

Alexander, S. 2012c, forthcoming, ‘Voluntary Simplicity and the Social Reconstruction of Law: Degrowth from the Grassroots Up,’ Environmental Values (Special Issue: Degrowth).

Alexander, S., 2012d. ‘Resilience through Simplification: Revisiting Tainter’s Theory of Collapse.’ Simplicity Institute Report 12h.

Alexander, S., 2012e. ‘Ted Trainer and The Simpler Way.’ Simplicity Institute Report 12d.

Alexander, S., and Ussher, S. 2012. ‘The Voluntary Simplicity Movement: A Multi-National Survey Analysis in Theoretical Context,’ 12(1) Journal of Consumer Culture 66.

Ayers, R., and Warr, B., 2009. The Economic Growth Engine: How Energy and Work Drive Material Prosperity. Edward Elgar, Cheltenham.

Ayers, R., and Warr, B., 2010. ‘Evidence of Causality between the Quantity and Quality of Energy Consumption and Economic Growth,’ 35 Energy 1688.

Bardi, U., 2011. The Limits to Growth Revisited. Springer, New York.

Barry, J., 2012. The Politics of Actually Existing Unsustainability: Human Flourishing in a Climate Changed, Carbon Constrained World. Oxford University Press, Oxford.

Daly, H., 1996, Beyond Growth: The Economics of Sustainable Development, Beacon Press, Boston.

Douthwaite, R., and Fallon, G., 2011, Fleeing Vesuvius, New Society Publishers, Gabriola Island.

Georgescu-Roegen, N., 1971. The Entropy Law and the Economic Process. London, Harvard University Press.

Gilding, P., 2011. The Great Disruption: How the Climate Crisis will Transform the Global Economy. London, Bloomsbury.

Global Footprint Network, 2012. Reports available at http://www.footprintnetwork.org/en/index.php/GFN/ [accessed at 31 March 2012].

Hall, C. and Klitgaard, K. 2012. Energy and the Wealth of Nations: Understanding the Biophysical Economy. Springer, New York.

Hamilton, C., 2003. Growth Fetish, Allen & Unwin, Crows Nest, NSW.

Hamilton, J., 2010. ‘Historical Oil Shocks,’ available at: http://dss.ucsd.edu/~jhamilto/oil_history.pdf (accessed 22 December 2011).

Hamilton, J. 2011. ‘Oil Prices, Exhaustible Resources, and Economic Growth,’ Working Paper, available at: http://dss.ucsd.edu/~jhamilto/handbook_climate.pdf

Hansen, J. et al., 2008, ‘Target Atmospheric CO2: Where Should Humanity Aim? Available at http://www.columbia.edu/~jeh1/2008/TargetCO2_20080407.pdf [accessed 31 March 2012].

Heinberg, R. (2011) The End of Growth: Adapting to Our New Economic Reality. Gabriola Island: New Society Publishers.

Heinberg, R., and Lerch, D. 2010. The Post Carbon Reader Managing the 21st Century’s Sustainability Crises, Healdsburg, Watershed Media.

Hirsch R., R., Bezdek, and R. Wendling, (2005), ‘Peaking of World Oil Production: Impacts, Mitigation, and Risk Management,’ Department of Energy Report, available at http://www.netl.doe.gov/publications/others/pdf/Oil_Peaking_NETL.pdf (accessed 22 December 2011).

Hirsch R., R., Bezdek, and R. Wendling, (2010) The Impending World Energy Mess. Burlington: Apoge Prime.

Holmgren, D. 2012. ‘Retrofitting the Suburbs for the Energy Descent Future.’ Simplicity Institute Report 12i.

Hopkins, R., 2008, The Transition Handbook: From Oil Dependency to Local Resilience, Green Books, Totnes, Devon.

International Energy Agency (IEA), 2008. World Energy Outlook 2008: Executive Summary, IEA Report, available at http://www.iea.org/Textbase/npsum/weo2008sum.pdf (accessed 22 December 2011).

International Energy Agency (IEA), 2010a. Key World Energy Statistics. Available at: http://www.iea.org/textbase/nppdf/free/2010/key_stats_2010.pdf [accessed 20 June, 2012].

International Energy Agency (IEA), 2010b. World Energy Outlook 2010: Executive Summary, IEA Report, available at http://www.iea.org/Textbase/npsum/weo2010sum.pdf (accessed 22 December 2011).

Jackson, T., 2009. Prosperity without Growth: Economics for a Finite Planet, Earthscan, London.

Latouche, S., 2009. Farewell to Growth Polity Press, Cambridge, UK.

Lawn, P. and Clarke, M. 2010. ‘The End of Economic Growth? A Contracting Threshold Hypothesis’ 69 Ecological Economics 2213.

McKibben, B. 2012. ‘Global Warming’s Terrifying New Math,’ Rolling Stone (July 19, 2012) available at: http://www.rollingstone.com/politics/news/global-warmings-terrifying-new-math-20120719 [accessed 5 August, 2012].

Meadows, D., Randers, J. and Meadows, D., 2004. Limits to Growth: The 30-year Update, Chelsea Green Pub., White River Junction, Vt.

Murphy, D. and C. Hall, 2011a. ‘Adjusting the Economy to the New Energy Realities of the Second Half of the Age of Oil’ Ecological Modelling 223: 67.

Murphy, D. and Hall, C., 2011b. ‘Energy Return on Investment, Peak Oil, and the End of Economic Growth’ Annals of the New York Academy of Sciences 1219: 52.

Murphy, T. ‘The Energy Trap,’ available at: http://physics.ucsd.edu/do-the-math/2011/10/the-energy-trap/ [accessed 5 June 2012].

Odum, E. and Odum, H., 2001. A Prosperous Way Down: Principles and Policies. University Press of Colorado, Colorado.

Purdey, S. 2010. Economic Growth, the Environment, and International Relations: The Growth Paradigm. Routledge, New York.

Rubin, J., 2009. Why Your World is About to Get a Whole Lot Smaller. London: Virgin.

Rubin, J., 2012. The End of Growth: But is that all bad? Random House, Toronto.

Solow, R. 1956. ‘A Contribution to the Theory of Economic Growth’ Quart. J. of Economics 70: 65.

Sorrell, S. 2010. 2 ‘Energy, Economic Growth, and Environmental Sustainability: Five Propositions,’ 1784.

Stern, D. and A. Kander (2011) ‘The Role of Energy in the Industrial Revolution and Modern Economic Growth.’ CAMA Working Paper 1/2011. Canberra: Centre for Applied Macroeconomic Analysis.

Trainer, 2010a. ‘Can Renewables etc. Solve the Greenhouse Problem: The Negative Case’ 38(8) Energy Policy 4107.

Trainer, T. 2010b. The Transition to a Sustainable and Just World, Envirobook, Sydney.

Trainer, T., 2011. ‘The Radical Implications of Zero Growth Economy’ 57 Real World Economics Review 71.

Trainer, T., 2012. ‘Can Renewable Energy Sustain Consumer Societies? A Negative Case.’ Simplicity Institute Report 12e.

Tverberg, G., 2012a. ‘Oil Supply Limits and the Continuing Financial Crisis’ 37(1) Energy 27-34.

Tverberg, G. 2012b. See articles on ‘Our Finite World’ available at: http://ourfiniteworld.com/

Tverberg, G. 2012c. Graph from ‘Our Finite World’ (Tverberg, 2012b) available at ‘World Energy Consumption Since 1820 in Charts’ [accessed 28 September 2012].

Tverberg, G. 2012d. Graph from ‘Our Finite World’ (Tverberg, 2012b) available at ‘Evidence that Oil Limits are Leading to Declining Economic Growth’ [accessed 28 September 2012].

Tverberg, G. 2012e. Graph from ‘Our Finite World’ (Tverberg, 2012b) available at ‘Why High Oil Prices Are Now Affecting Europe More Than the US.’ [accessed 28 September 2012)

Victor, P., 2008. Managing without Growth: Slower by Design, not Disaster, Edward Elgar, Cheltenham, UK.

________________________

[1] Dr Samuel Alexander is co-director of the Simplicity Institute and a lecturer with the Office for Environmental Programs, University of Melbourne.

Thanks Sam. Great article again. I would only one point to the mix. Yes, growth is absolutely dependent on cheap/abundant energy but I also think that without growth, market economies are in terrible shape (recession, bankrupcies, unemployment all quickly follow). So the degrowth solution – if it is not to descend into barbarism – will need to involve basically socialist economic planning, to ensure all have a fair share on the way down. Soral Sarkar argues this very well. Govs and mainstream public are, of course, totally unwilling to face up to this. I hope we could win Gov over to a degrowth eco-socialist platform, but agree with Ted and yourself that the TT movement is the best place to work at the movement. Resilience may, indeed, be the best we can hope for…Keep it up.

Agree with Jonathon, mainly. I am not sure that the Transition Towns will do it.

My thoughts are that anywhere with more than 2000 people will struggle.